You simply can’t get on the ladder alone.

The average house price is now £268,349 — over 9x the average salary.

Young first-time buyers are more likely to be joint owners than not.

And around 80% of young people would be open to buying a place with someone who isn’t their partner to start building equity.

It might seem scary but your first home doesn’t have to be a lifetime commitment. Buying with friends can be a great way to stop renting and start building your life and ensure house prices don’t get too far out of reach.

Here’s a ‘how to’ guide:

1. Define your budget, and be clear about who is involved

It’s obviously important to know what you can afford when it comes to buying a home. You’ll need at least 5% deposit but you can often afford more if you are buying together. Check out this calculator to see what the difference a few others can make to your purchasing power.

Be clear about what each of you is bringing to the purchase, and who else is involved in the purchase — around half of first time buyers are supported by the Bank of Mum and Dad!

2. Find a mortgage that works for you and your other buyers

Only a few lenders will take into consideration more than two salaries, but most will allow there to be 3 or 4 people on the mortgage. A mortgage broker can be especially helpful for a group of first-time buyers in guiding you through the process.

New mortgages are coming onto the market, such as Generation Home , focused at purchases where family and friends are involved.

You will all want to consider the interest rate, the level of repayments and ability to make early repayments or exit the mortgage when you need to. Websites like Which? can provide a useful place to research.

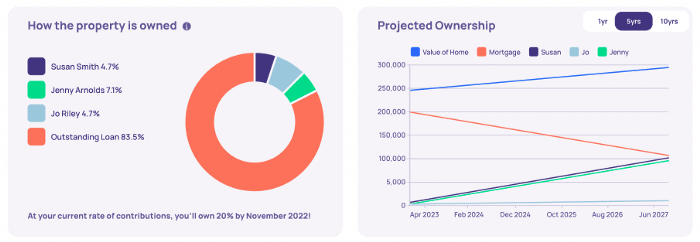

3. Track unequal contributions to the home

If you’re buying with others, you will likely bring different deposits and different salaries to the purchase. With other people contributing, like the Bank of Mum and Dad, it can get even more complicated!

To keep all involved happy it’s important to ensure that everyone gets out what they’ve put in, and feels like their individual stake is protected.

Platforms like MaryR can track who is contributing what to the home and provide a real-time share in the home, and what it is worth.

4. Put in place the right legal agreement

When you buy the home, if you are bringing different financial contributions to the property purchase, you will most likely want to own under ‘tenants in common’.

This enables you to own the property in unequal shares, and gives each of you the right to sell, remortgage or give away your share.

You can set these out as you buy a home. Or if you are live-tracking contributions to the property with MaryR or something similar, you will want to put in place a Deed of Trust. This is a legally binding contract referencing how you are calculating the changing shares.

5. Be clear about the exit

When you are buying a home with a friend, it is important to discuss what will happen when one of you wants to sell their share.

Circumstances change, and if a new boyfriend or girlfriend arrives on the scene it can quickly shift priorities. Be honest about what would happen in that scenario.

Use remortgage dates or milestones like when you’ve built up enough equity to purchase your next place, as a point to check in with your co-owners.

Back to blog